Economic uncertainty remains as tariffs' impact yet to be realized

tariffs is the ‘most beautiful word in the dictionary’

In the weeks and days leading up to the November 2024 election, poll after poll showed the economy and inflation were voters’ top concern. So aware was the administration of that very real concern that Trump made Make America Affordable and Energy Dominant Again a top priority upon entering office. Within 2 months of his 2nd tenure in office, the White House would not rule out a recession, inflation had not been curbed and consumer prices had not significantly declined as Trump pursued a strategy of tariffs, the ‘most beautiful word in the dictionary’ according to the president on the campaign trail.

On April 2nd, Trump declared ‘Liberation Day’ in the White House Rose Garden to firmly assert his administration’s America First trade policy using national emergency powers to declare sweeping tariffs on all US imports. After the stock market’s initial reaction, JP Morgan posted the following less than 2 weeks after ‘Liberation Day’:

The [market] chaos suggests a questioning of confidence

Despite President Trump's ‘pause’ on some planned tariffs, uncertainty looms large: What's the White House's ultimate goal? Can tariff revenue truly bridge the $6 trillion deficit? Will uncertainty stifle U.S. investment? Can consumers absorb the shock? Is AI investment still viable with rising tech costs?

In the meantime, duties remain at their highest in the post-war period.

Since ‘Liberation Day,’ those mounting concerns have hit U.S. stocks, bonds, and the dollar hard—a rare trifecta.

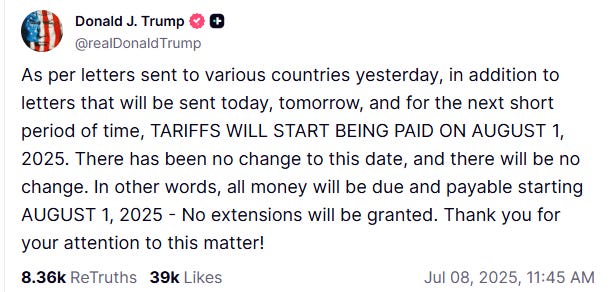

In response to the market chaos, Trump paused tariffs for 90 days and his administration infamously claimed that would be enough time to make 90 trade deals. Those 90 days would have ended on July 8th, but TACO Trump extended that deadline to August 1st, this Friday.

On July 8th, Trump posted on Truth Social letters the White House sent to 14 countries announcing steep tariffs to take effect on August 1st if deals were not reached. Those nations were Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, Myanmar, Bosnia and Herzegovina, Tunisia, Indonesia, Bangladesh, Serbia, Cambodia and Thailand.

At the July 8th Cabinet meeting, President Trump threatened a 200% tariff on pharmaceutical imports. US Commerce Secretary Howard Lutnick told CNBC, “With pharmaceuticals and semiconductors, those studies are being completed at the end of the month, and so the president will then set his policies then, and I’m going to let him wait to decide how he’s going to do it.”

To address the market, Stephen Miran, chairman of Trump’s Council of Economic Advisers, spoke to CNBC about whether the administration believed tariffs would cause consumer prices to rise:

Rare events happen. We get pandemics or, or meteors or whatever. [But] there’s just no evidence thus far of it happening.

With the trade deadline only days away, how fares the US economy?

According to an estimate from the U.S. Bureau of Economic Analysis, “real gross domestic product (GDP) increased at an annual rate of 3.0 percent in the second quarter of 2025 (April, May, and June).” That growth exceeds the Dow Jones 2.3% projection for the quarter. CNBC reports “financial markets reacted little to the report, with stock index futures mixed and Treasury yields higher.”

The US dollar strengthened against major peers after announcements of the US-EU trade deal and the Federal Reserve decision to keep interest rates unchanged. Reuters reports the dollar index “was up 0.96% at 99.82, hitting its highest level since May 29 and on course to post its first month of gains this year.”

However, the Treasury Department announced this morning it will “issue more short-term debt to help fund its widening budget deficit.” For just this quarter, the department needs to raise $1 trillion “to keep the government running,” which is nearly double the $554 billion raised last quarter (April to June 2025).

Are tariffs generating significant revenue?

Revenue from tariffs has grown to $20 billion per month which would pace to $240 billion per year. While that is a significant improvement over prior years, the current tariff revenue realized is measured in 12 figures annually while the national deficit is measured in 13 figures, with the Congressional Budget Office estimating the federal budget deficit totaled $1.3 trillion in the first nine months of fiscal year 2025.

Part of the issue is the Trump administration falling very short of its stated goals of 90 deals in 90 days. To date, only six trade deals have been announced. Tariffs on goods from the European Union and Japan will be at 15%, from the United Kingdom at 10%, from Indonesia and the Philippines at 19% and from Vietnam at 20% (with goods being routed through Vietnam at 40%).

As Trump’s self-imposed trade deadline rapidly approaches, trade deals with China, Canada and Mexico are still unresolved. For context, America’s top importers last year were the European Union ($605.8 billion), Mexico ($505.9 billion), China ($438.9 billion), Canada ($412.7 billion), Japan ($148.2 billion) and Vietnam ($136.6 billion). And of the 14 nations which Trump publicized his trade letters, only Japan has reached a verbal agreement which has not yet been signed. Not to mention a lack of trade deals with the rest of the world.

Even within announced trade deals, significant ambiguity remains. For example, European Commission President Ursula von der Leyen said the US-EU trade deal “did not contain any decision regarding the wine and spirits industry,” which should be detailed in the coming weeks. Regarding pharmaceuticals, a 15% tariff on goods from the EU “could cost the pharmaceutical industry between $13 billion and $19 billion.” Pharmaceuticals represent the EU’s largest export to the US totaling near $120 billion last year. Given Trump’s statements earlier this month, the pharma sector cautiously awaits details to be finalized in the trade agreement. Their concerns were voiced by Alex Schriver, the senior VP of public affairs for pharmaceutical industry’s largest lobbying group: “Every dollar spent on tariffs is a dollar that cannot be invested in American manufacturing or the development of future treatments and cures for patients.”

What about consumer pricing?

At a press conference today, Chair of the Federal Reserve Jerome Powell summed up why market uncertainty remains:

Our obligation is to keep longer term inflation expectations well anchored and to prevent a one time increase in the price level from becoming an ongoing inflation problem. Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen.

Since the tariffs deadline has not yet arrived, consumer prices have not yet been affected. Trump indicated last week that the base level for foreign tariffs will be 15% and as high as 50%, with lower rates applied to countries which increase American imports. To alleviate public concern, White House spokesman Kush Desai told CBS, "The administration has consistently maintained that the cost of tariffs will be borne by foreign exporters who rely on access to the American economy, the world's biggest and best consumer market."

US companies would disagree. Carmakers, for example, have been mostly absorbing the extra costs and losing profits. Companies like Walmart and Procter & Gamble have already stated they will raise prices. And companies like Nestlé and General Electric are also considering increasing consumer prices to curb the effects of tariffs on their profit margins. Yale Budget Lab projects prices for foreign-made leather goods could increase by more than 40% and electronics by at least 20%. Plus US consumers do not know how the pharmaceutical industry will respond to tariffs.

Adding to tariffs are supply chain issues and labor shortages. Yesterday a new analysis released suggests factory costs could increase between 2% to 4.5%. Chris Bangert-Drowns, the researcher who conducted the analysis, said “there’s going to be a cash squeeze for a lot of these firms.” Given factories’ small profit margins, increased costs “could lead to stagnation of wages, if not layoffs and closures of plants.”

Combined with factory costs is the administration’s crackdown on immigrant labor. According to the Economic Policy Institute, “4 million deportations would result in the loss of 3.3 million jobs held by immigrants in the US and 2.6 million US-born employees, hitting industries including construction and childcare.”

The White House’s Council of Economic Advisers reported this month “prices of imported goods have not only fallen this year, but also declined faster than overall goods prices since February. These findings contradict claims that tariffs or tariff-fears would lead to an acceleration of inflation.”

To be continued after the trade deadline..